By: Jayvee R

2023/12/05

The numbers in the financial statement may be intricate and confusing, but whether you like it or not, financial statements are the lifeblood of a company. It shows pertinent information sizing up a company’s worth, income and expense, cash flow, expense tracing as well as profitability.

Additionally, it helps shareholders including investors and financial analysts to evaluate, measure and see their return of investment (ROI) and make informed and smart decisions as well as wise investment choices. By comparing past and present performance, the company is able to predict its performance and measure its growth.

Understanding income and expense is easy to comprehend. These two are part of the financial statement. However, there are four sections of a company’s financial statement. These are: the balance sheet, the income statement, the cash flow statement and the explanatory notes with some additional analysis of a company’s shareholders’ equity and retained earnings.

Aside from these, one should also be able to review non-financial information that could affect the company as a whole, like the state of the economy, other competitors that are trying to make their mark and just recently, which brings closer to home, the on-going pandemic.

Sections of a Financial Statement:

Balance Sheet

– The financial position and standing of a company is shown clearly by the balance sheet. It provides detailed information of the company’s assets and investments as well as debts and levels of equity. This aids both investors and creditors to understand the position and performance of the company.

The balance sheet has three elements: assets, liabilities and owner’s equity. For every transaction shown in the balance sheet, the central accounting equation is: Assets = Liabilities + Owners Equity.

Income Statement

– This part of the financial statement includes income and expense, expense tracing, losses and profit. Understanding all these can help evaluate performance, past and present and determine the future cash flow.

Cash Flow Statement

– This obviously shoes the inflow and the outflow of the cash flow through the course of the financial period which contains the operating, investing and financing aspect of the business. As such, it provides a glimpse whether or not a company has sufficient funds to pay for both purchases and expenses. There are three sections to the cash flow statement: Cash Flow from Operating Activities, Cash Flow from Investing Activities and Cash Flow from Finance.

Importance of the Financial Statement

No doubt, a financial statement showing income and expense, cash flow, expense tracing is important. However, it varies from different points of view. It is vital to know how important financial statements are according to the point of view of the following:

Management

– The financial statement shows the financial position of the company which gives management the proper understanding of the performance of the company as against other related businesses.

Shareholders

– As part owners of the business, shareholders have to understand how the company has been performing so far. They also need to learn not just the income and expense, cash flow and expense tracing but also about dividend payout ratios and future dividends forecast.

Creditors and Lenders

– Financial statements shows metrics that describe liquidity, debt and profitability. Creditors and lenders want to know about the company’s position as far as debt is concerned. If the debt level is more or higher than the other competitors in the same industry, it just goes on to show that the company is over leveraged and being able to analyze can help them in their decision making.

Employees

– They have the right to know. Although some companies do not entirely divulge their financial information to their employees, it is also advisable to at least show them the present financial standing so they have the security of tenure and they will understand future salary appraisals.

Government

– Financial statements are needed by the government for taxation purposes. They can also give a bird’s eye view of the economy’s performance in general.

Company

– By looking at income and expense, expense tracing, evaluating debt and liability management, studying trend analysis, the company will benefit from the information and will help the business understand the current overall health of the company and its weakness.

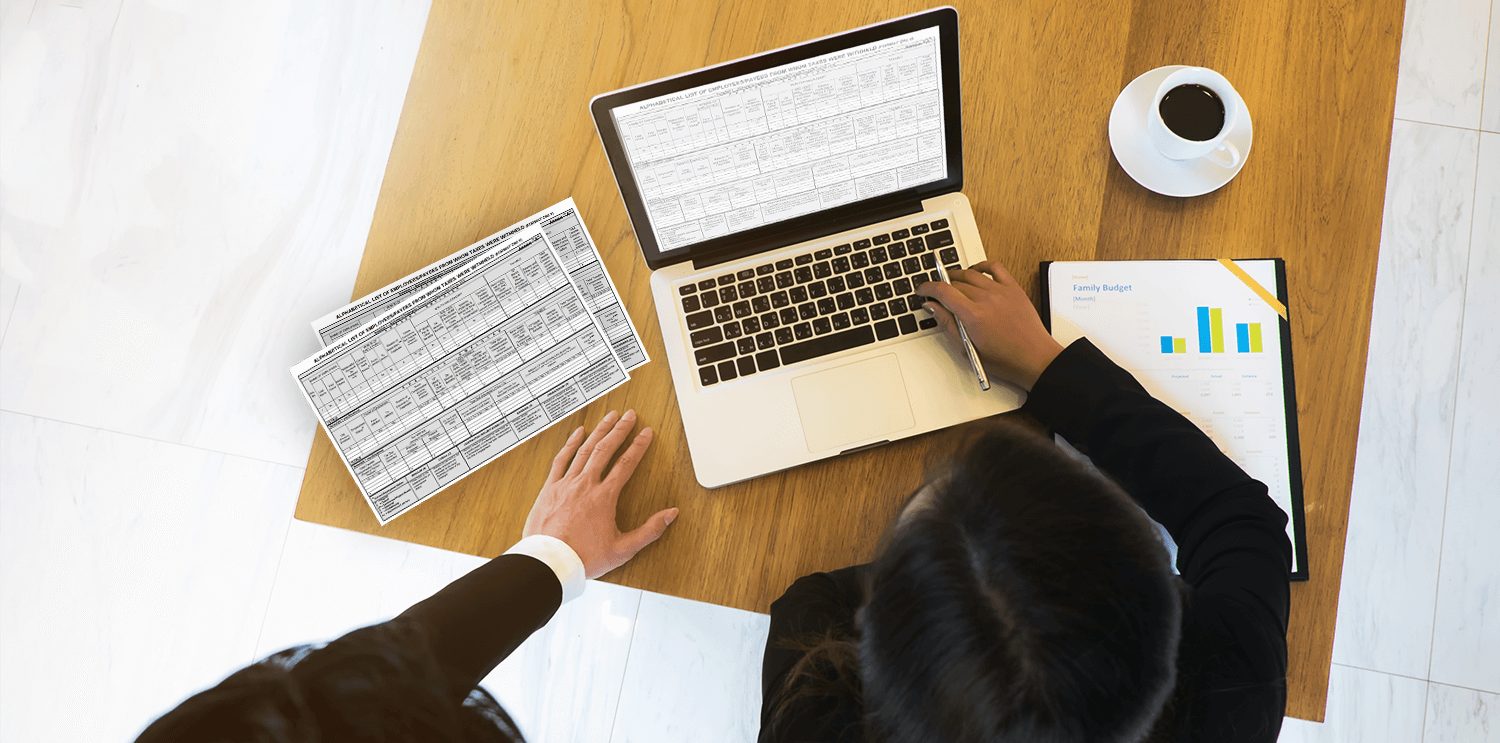

Indeed, financial statements are important. Yet, how can a company come up with a dependable and seamless financial statement without sacrificing time, resources and quality? Well, look here! There is a free accounting software for small business that is cloud based, capable of producing the financial statements required without having to hire many accountants to do the job.

If you are a start-up company searching for the perfect free accounting software for small business, then this one is for you! Save up some money on fees and resources. EasyFS free accounting for small business provides a highly accurate and real time view of your financial statements and take note, it is FREE!

EasyFS free accounting for small business is a cloud-based software that provides higher accuracy and real-time availability of financial reports. Coordination with teams is much faster with prompt customer service. The free plan surely is cost-effective as it has lower costs on deployment and maintenance. Here are the key features of EasyFS free accounting:

- Free plan

- Cloud-based

- Cost efficient and low maintenance

- Provides income and expense reports

- Provides financial statements

- Easily accessible anywhere and anytime

- Improved customer service

- BIR Compliant

Consider EasyFS free accounting for small business. Do not let those financial statements overwhelm you.

Take this free plan from EasyFS. Call us now at +63-32-256-2904 or +639088601619 or leave us a message here.